It’s no secret: medical insurance is the biggest focus for both employers and employees while all of the other benefits become almost an afterthought. It goes without saying – health insurance costs are spiraling out of control and should be the primary focus of a benefits package… but we don’t want to ignore the others benefits because of it as there may still room for savings.

Half of all seniors will need long-term-care insurance at some point in their life and one-in-six people will spend over $100,000 for long-term care services or support in their life. However, there are some methods to help prepare and save to pay for these costs.

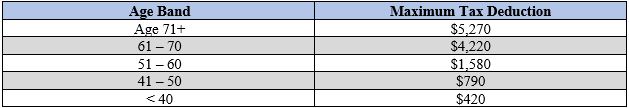

Kiplinger Tax Letter recently released a report that highlights the potential tax savings for a long-term-care product that many people may not know about. Long-term-care costs of chronically ill individuals can be written off and deducted from taxes (if he/she is unable to perform at least two activities of daily living or ADLs) – however, premiums that one pays for long-term-care products are also tax deductible. For 2019, taxpayers who are age 71 or older can deduct up to $5,270 per person. From there, the deduction amounts are capped based on an individual’s age band:

There are a few policy provisions that must be satisfied in order to write off

the premiums paid for a long-term-care policy, too. For example, the policy

cannot be a hybrid life insurance & LTC product, it must be renewable, dividends

under the policy generally cannot be used to reduce future premiums, it cannot

pay for costs that would be paid for Medicare (unless Medicare is the secondary

payer) and more.

For more information on long-term care products or any implications of the tax savings, contact us today!